Bell Peppers

Coastal California red bell peppers are experiencing harvest delays; volume is expected to recover next week as production transitions to the Coachella Valley.

Red Bells

- Markon First Crop (MFC) and Markon Essentials (ESS) Red Bell Peppers are extremely limited; packer label will be substituted as necessary

- The California growing regions of Hollister and Oxnard cancelled harvesting on Thursday, November 10 due to extremely muddy conditions; attached is a photo for reference

- Crews are expected to return on Friday, November 11

- Evening temperatures in the mid-30s are hampering the ripening process

- The transition to the California desert region will start on November 14

- This week’s high markets will soften over the next two weeks

Green Bells

- MFC and ESS Green Bell Peppers are available

- The California desert has adequate supplies

- Crews are harvesting this week

- Quality is very good; size is dominated by large and medium peppers

- Georgia and North Florida growers are seeing production delays due to Tropical Storm Nicole

- The Mexican season (into Nogales, Arizona) has started in a limited manner

- Expect markets to increase slightly

Broccoli

- Supplies from both the Salinas and Santa Maria valleys are diminishing as the season winds down

- Widespread pin rot continues to affect the appearance and shelf-life of crowns

- Cooler weather, especially low nighttime temperatures, and rain in the forecast for this week will slow head maturation and could increase the occurrence of mildew in finished packs

- Expect elevated markets and very limited supplies until the third week of November

Brussels Sprouts

The Brussels sprouts market is inching up as holiday demand increases.

- Salinas and Santa Maria, California are the primary growing regions at this time; harvesting will continue through late December

- Growers in Mexico will ramp up production in early December

- The size profile is dominated by jumbo supplies; small and medium sizes are readily available, though not as abundant

- Overall quality is strong; some lots are exhibiting insect pressure and off color

- Expect active markets through late December; prices will ease as holiday demand subsides and Mexican volume ramps up

California Strawberries

California strawberry quality continues to recover after heavy rainfall in all California growing regions. Expect to see quality challenges and elevated markets for the next 7-10 days.

Santa Maria and Oxnard, California

- Volume remains limited; harvesting has been impacted by rain and cold overnight temperatures

- Quality concerns include soft skin, decay, white shoulders, and pin rot

- The industry is in a demand-exceeds-supply situation

- Expect strong demand and elevated markets through the month of November

Central Mexico

- The season has begun; volume is beginning to increase after a slow start to the season

- Size is medium (approximately 19 to 23 berries per one-pound clamshell)

- Limited quantities have begun to cross into McAllen, Texas; volume will increase in late November/early December as size and quality improves

Florida

- Harvesting has begun in a very limited way; fruit will hit the market in early December

- Orders for MFC Strawberries are estimated to begin shipping the week of December 12

Celery

- Celery markets are rising due to increased demand and reduced industry supplies

- The Michigan season has ended, shifting demand to California

- Oxnard production is underway; disease pressure in initial lots is reducing harvestable yields

- The Salinas season is winding down and is expected to be finished mid- to late November

- Santa Maria production will continue year-round

- Arizona and California desert production will start early to mid- December

- Expect elevated markets and strong demand through the holiday season

Cilantro

- Cooler weather in the primary growing regions has reduced harvestable yields at the field level

- Arizona and California desert supplies are delayed by two to three weeks, incurring transfer fees to get product to Yuma crossdock

- Strong winds are leading to tip burn and increased dirt in final packs

- Expect markets to continue rising through early to mid-December amid holiday demand

From The Fields: Desert Region Lettuce Outlook

Please click here to view a Markon Live from the Fields video regarding the current supply and quality outlook for lettuce items in the Arizona/California desert growing region.

- Many suppliers of lettuce and tender leaf crops are done in the Salinas Valley and have started production in the desert region

- The crops are healthy and there is no presence of the types of soil disease and virus pressure that brought ended the Salinas season early

- Suppliers are roughly 5-7 days ahead on most crops, which has kept case weights for commodity packs well below normal

- Seeder/long core has been present in many fields and may continue to be present for another 7-10 days

- The forecast throughout November calls for cool, windy conditions overall with below average temperatures

- Expect light case weights for the next three to four weeks or longer given the cool forecast and suppliers being ahead of their harvest schedule

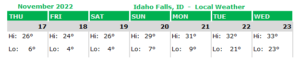

From The Fields: Desert Region Weather

The Arizona/California desert growing region is experiencing high winds with gusts ranging from 40-50 mph. Daytime highs are 10 degrees below normal and will stay that way through Saturday, November 19. Light-to-moderate lettuce ice is expected over the next several days as morning lows dip into the mid-30°s to low 40°s.

Potential challenges for lettuce and tender leaf items resulting from the high winds and cold temperatures include:

- Elevated dirt/mud in commodity and lightly processed items

- Epidermal blistering and peeling

- Increased wind damage

- Prolonged low case weights due to slowed plant growth and dehydration

From The Fields: Lettuce Ice in The Desert Region

Temperatures in the Arizona/California desert growing region dipped into the mid-30°s to low 40°s this morning, causing light-to moderate lettuce ice to develop. Harvesting crews for lettuce and tender leaf items will be delayed 2-3 hours or until the ice has fully thawed. Value-added production and loading delays can be expected through the weekend with more cold temperatures and lettuce ice in the forecast.

Grapes

The California season will wrap up in late December. The offshore Peruvian/Chilean season will begin in mid-December. Expect pricing to gradually increase as the California season winds down.

Green and Red Grapes

- ESS Grapes are available

- California green and red grapes are expected to be in season until mid-December

- Quality is good; some rain-damaged fruit is being reported

- Offshore Peruvian/Chilean green grapes are expected to begin shipping in mid-December

- Expect pricing to gradually increase through the end of the California growing season

Portioned Grapes

- MFC Lunch Bunch Grapes are available

- California portioned grapes are expected to be in season until mid-January

- Quality is good; some rain-damaged fruit is being reported

- Offshore Peruvian/Chilean portioned grapes are expected to ship in mid-January

- Expect prices to rise through the end of the California growing season

Green Leaf, Iceberg, And Romaine

Green leaf, iceberg, and romaine supplies are increasing as production in the Arizona and California desert ramps up. Extremely elevated market levels persist, but will decrease in the coming weeks.

- Initial quality in the Arizona/California desert regions is very good; low weights, odd shape, puffy texture, seeder, and wind damage are present in some early lots

- Green leaf and romaine supplies are more readily available compared to prior weeks, causing markets to begin to inch down

- Iceberg remains limited; prices have peaked and are expected to decrease next week

- Expect markets to continue to decline into early December as supplies increase in the desert and Thanksgiving demand subsides

Green Onion

- Ready-Set-Serve (RSS) Washed & Trimmed Green Onions are limited; packer label is being substituted as necessary

- Supplies and quality are slowly increasing in the Mexicali growing region; recent heavy storms have significantly reduced yields and slowed further maturation

- Prices are rising amid holiday demand and cooler weather in the growing region

- Expect markets to remain elevated through November

Idaho Potatoes- Limited Production

Extremely low temperatures persist in Eastern and Southern Idaho. Suppliers will load on limited production schedules around the Thanksgiving holiday.

- Temperatures need to be 18 F° or higher for several hours to haul potatoes from cellars to packing sheds in order to avoid freezing raw product

- Many suppliers are electing to limit production on select days next week in observance of the holiday, helping the continued effort to extend potato volume

- Reduced production and delayed loading are expected through next week

- Advanced order lead time is highly recommended for order fulfillment; orders loading through Saturday, November 26 should be submitted by end of day tomorrow

Melons

Cantaloupe and honeydew supplies are tightening; Prices will strengthen over the next few weeks. MFC Cantaloupes and Honeydews are extremely limited; packer label is being substituted as needed.

Honeydews

- The domestic honeydew season has finished; growers in Northern Mexico are moving into their winter fields

- Offshore supplies are expected to start shipping the last week of November

- Mexican quality is fair; ground spotting and wind scarring are occasional issues

Cantaloupe

- The domestic cantaloupe season will end in the next two weeks

- Mexican supplies will ship through mid-December

- The offshore season has started in a light way with Guatemalan cantaloupe (into Florida); rising ocean freight costs are reducing overall shipments of offshore melons to West Coast ports

- Quality is fair out of all current growing regions

Tomatoes

Tomatoes markets are elevated due to this season’s severe storms. MFC Tomatoes are extremely limited; packer label will be substituted, as necessary.

- All varieties of Florida tomatoes are limited after recent hurricanes

- Small sizes and No. 2 grades with scarring are most plentiful

- Improvements aren’t expected until January when South Florida’s replanted crops are harvested

- Mexican round and Roma harvests are adequate in both Eastern Mexico and Baja

- Demand is strong, pushing up markets

- Sufficient supplies will resume in January when replanted crops are harvested in Culiacan

- Grape and cherry tomatoes are snug; however, will rebound by mid-December

- Most suppliers are requesting quality leniencies for the remainder of 2022

- Expect high prices over the next six weeks

Watermelons

Watermelon demand is currently exceeding available supplies out of Northern Mexico. Weather has been a factor.

- Cold weather in the main growing region of Sonora, Mexico is slowing plant growth and hindering production

- Supplies are extremely limited; growers are struggling to fill full truckloads

- Fall weather is causing shorter days and cooler temperatures leading to lower-quality melons

- Recent rains in the region caused vine disease, further lowering yields

- Expect lower sugar content, lighter colored melons

- Elevated markets and tight supplies will persist through November (until offshore melons enter the market this winter)

Please contact your Markon customer service representative for more information.

©2022 Markon Cooperative, Inc. All rights reserved.