UPDATE SUMMARY: WEEK OF JUNE 20, 2022

Asparagus

Markets have risen in the month of June, especially prices for larger sizes (extra-large and jumbo). Supplies are tightening as the domestic season winds down. New crop production has not reached full capacity in Central Mexico.

- The Washington and Michigan seasons are ending; a limited quantity of California product will remain available through the end of June

- Peruvian asparagus (shipped into Florida) is supplementing the market on the East Coast, but volume isn’t high enough to hold prices steady industrywide

- Peruvian quality is average but limited to East Coast distribution

- Production continues to ramp up in Central Mexico, although periodic rain events and Tropical Storm Celia will impede harvesting and impact crop maturation

- Mexican supplies have the strongest quality; product is exhibiting straight spears with firm tips and grassy flavor

- Expect industry quality to remain challenged for the next 7-10 days, and to improve in early July

- Prices will remain elevated through early July; with market is anticipated to stabilize following strong demand for the Fourth of July holiday

Bell Peppers

Excessive heat in California and along the East Coast is accelerating the maturity of bell pepper crops. Some growing regions are ahead of production schedules.

Red Bells

- Markon First Crop (MFC) and Markon Essentials (ESS) Red Bell Peppers are limited; packer label will be substituted as needed over the next week

- California is experiencing a heat wave (109F in the Imperial Valley) that will force an early end to the desert season

- The San Joaquin Valley will begin very limited harvests this week; temperatures over 100F will assist in the fruit ripening process

- Expect low California volume for the next week (until the San Joaquin/Bakersfield area is well established)

- Supplies are tight in Central Mexico (crossing in South Texas) this week

- Orange bell peppers may be substituted on a case-by-case basis

- Markets will remain elevated for another week, then start to ease

Green Bells

- MFC and ESS Green Bell Peppers are available

- California’s San Joaquin Valley is at peak production

- Quality is excellent

- Color is light green

- East Coast production is steady despite recent excessive heat in Georgia (95-100F)

- Quality is average: sun scalding is being observed during the grading process

- The Carolinas have started limited production; large sizes are most plentiful

- Local summer programs (including Kentucky, Virginia, and New Jersey) will start in mid-July

- Markets should inch down slightly over the next two weeks

Blueberries

Supplies are becoming extremely limited due to diminishing supplies out of California; expect tight supplies and elevated markets over the next two to three weeks.

- California season is coming to an accelerated end due to warm temperatures in the Central Valley

- Pacific North West growing region has been delayed upwards of three weeks due to inconsistent weather

- Once Pacific North West season kicks off it will be the main growing region for blueberries

- Expect tight supplies and high markets over the next 2-3 weeks

Broccoli & Cauliflower

Broccoli

- MFC Broccoli is available

- Supplies are decreasing out of Central Mexico as the crop transitions to northern growing regions for the summer months

- Demand is shifting to West Coast supplies to compensate, pushing up markets in the Salinas Valley where supplies and quality are steady

- Expect prices to increase in both areas over the next 7-10 days until local/regional production starts for the summer

Cauliflower

- ESS Cauliflower is available; packer label is being substituted as needed due to quality

- Salinas Valley volume is steady; demand is strong

- Expect markets to follow broccoli upwards due to the recent heat wave; oversized heads, bolting, leafy curds, and browning will become more prevalent, reducing yields

- West Coast prices will continue inching up through early July until local/regional harvesting begins

Strawberries

Supplies are ample; demand is steady. Expect volume to decline in early July as the Salinas/Watsonville season will be past peak production.

Salinas/Watsonville

- MFC Strawberries are available

- Volume is anticipated to climb as favorable weather is forecast

- Extended high temperatures could affect overall fruit quality

- Demand remains steady; no changes are expected over the next two weeks

- The season is at its peak; volume will decline through July, causing markets to rise

Santa Maria

- Fields are entering the back half of the season

- Warm weather has increased stocks

- Fruit size is medium (18-20 per 1-pound clamshell)

- Quality is good: some green shoulders have been reported

Oxnard

- Supplies are extremely limited; most growers are finished harvesting for the season

- Remaining quality is fair at best

Cantaloupe & Honeydew

MFC Cantaloupe and Honeydew are limited as the spring desert season winds down; packer label will be substituted as needed until the San Joaquin Valley season starts the week of July 11.

- Cantaloupe prices are inching up as the Arizona/California desert season winds down over the next two weeks

- Size is peaking on 9ct

- 15-count sizes are extremely limited and 12-count are also beginning to tighten up

- California’s San Joaquin Valley cantaloupe season will kick off the week of July 11; expect a better range of sizing and markets to ease at that time

- Flexibility on cantaloupe sizing may be needed through the transition

- Honeydew markets are fairly steady with adequate availability on all sizes at this time

- Markets are poised to rise over the next two weeks

West Coast Heat

The unseasonably hot temperatures currently being recorded in California’s Salinas Valley and other West Coast growing regions are raising serious concerns over quality and shelf-life for many key fruit and vegetable crops. Yesterday was the 2nd significant heat spike of June, with temperatures reaching into the 90s even near the coast and above 100° for much of the inland area, but in general, temperatures have been above normal since early in the month and are expected to remain high through early July.

Below is a list of quality and shelf-life concerns that can be expected in commodity and value-added packs over at least the next two weeks, as well as some charts that illustrate the current temperature forecast.

Baby Leaf and other Lettuce items may develop:

- Bolting/Seeder

- Dehydration

- Internal burn

- Inconsistent growth

- Increased insect pressure

- Growth crack

- Rib blight

- Shortened shelf-life

- Sun burn/Sun scalding

Broccoli and Cauliflower may develop:

- Accelerated or inconsistent growth

- Dehydration

- Hollow core

- Pin rot

- Shortened shelf-life

Strawberries may develop:

- Decreased sizing

- Increased bruising

- Soft texture

- Shortened shelf-life

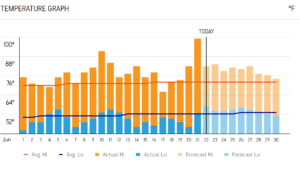

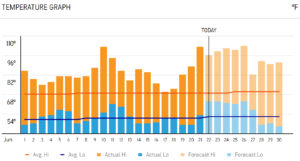

Coastal Salinas Valley Temperatures:

Inland Salinas Valley Temperatures:

Arizona/California Desert and San Joaquin Valley Growing Regions

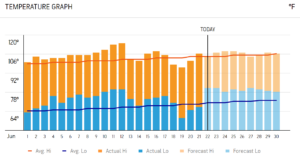

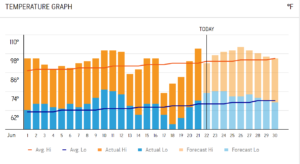

Excessive heat in California’s Imperial Valley (104º to 108º) and San Joaquin Valley (100º to 103º) will impact multiple commodities. High temperatures will affect harvesting hours and may cause softness, reduced sugar, shrivel, and sunburn in the below crops:

- Bell Peppers

- Blueberries

- Cantaloupe

- Eggplant

- Honeydew

- Oranges (regreening)

- Squash

- Tomatoes

- Watermelon

Imperial Valley Temperatures:

San Joaquin Valley Temperatures:

Markon suppliers will harvest in the early hours of the morning to avoid the peak temperatures for their production crews and commodity and value-added products. In some instances, production may be curtailed for the well-being of harvesting crews, which could lead to supply issues.

Maintaining the cold chain throughout distribution is critical for maximizing quality and shelf-life.

Iceberg & Romaine

Markets are rising. MFC Premium Lettuce and Romaine is available.

- Foodservice demand started to increase last week and will continue to get stronger this week

- High heat earlier this month, followed by another heatwave this week, are increasing insect pressure, INSV, and sun scalding, reducing yields throughout the industry

- Salinas Valley suppliers typically scale back overall plantings at this time of year when demand shifts to regional harvesting areas during the summer months (Canada, the Midwest, and the East Coast)

- Expect prices to continue inching up over the next 7-14 days

Independence Day

Markon’s buying office will be closed on Monday, July 4; many processors will adjust loading and production schedules due to the holiday.

- Markon’s Salinas consolidation dock, CCC1, will have slightly reduced hours Monday July 4, 8am-10pm

- Taylor Farms’ loading docks will be open normal hours; trucks are urged to call by 8:00 a.m. PDT to schedule appointments

- 4Earth’s consolidation dock will load trucks on Independence Day (Monday, July 4)

- The Los Angeles Produce Market will be closed

- 4Earth will not be able to purchase off the market

- Northwest potato shippers’ sales offices and loading docks will be closed Independence Day(Monday, July 4)

- See the attached spreadsheet for specific ordering deadlines and dates

Pears

MFC Washington D ’Anjou Pears will be available through late July. New crop California Bartlett pears will begin shipping the week of June 11.

Washington

- Storage supply quality is excellent

- Remaining stocks are dominated by large size pears, 90- and 100- count sizes

- 110-count and smaller pears are limited

California

- Growers pack and sell by the count as opposed to the volume-fill method used in Washington

- California suppliers ship 40-pound packs; Washington growers use 44-pound cartons

- Due to this pack difference, California ships approximately 6 to 10 fewer pieces of fruit per unit compared to Washington

- The attached photos show Washington and California pear packs

2022-2023 Washington New Crop

- The Bartlett season is forecast to begin in mid-August

- D ‘Anjou production will start in early September

Potatoes

Idaho and Washington storage potato supplies continue tighten. Prices are rising.

- The market continues to climb

- All sizes will remain limited until new crop starts shipping in early August

- Several Idaho and Washington suppliers will experience 7- to 14-day supply gaps in early August, pushing demand toward those with remaining stocks

- MFC suppliers will implement six-week average allocations

- Order lead time of at least five business days is recommended for the remainder of the storage crop season

- Quality is fair in remaining storage stocks; hollow heart, along with pressure and shoulder bruising will be seen

- Pressure and shoulder bruising (soft, external indents) result from constant contact with adjacent potatoes, or the floor, while raw product sits in storage piles

- Hollow heart (small, irregularly shaped internal craters) develops internally during the season when potatoes grow faster than normal due to adverse weather

2022-2023 Season

- New crop Norkotah harvesting is expected to begin in early August

Tomatoes

New tomato regions across the country are experiencing early summer heat. Moderate demand is keeping markets steady. Markon First Crop Tomatoes are available.

- East Coast production of round, Roma (limited), and grape tomatoes is slowing down due to high temperatures

- Quality is good with all sizes available

- The summer growing regions of Tennessee, North Carolina, and Virginia are expected to start harvests in early July

- California’s San Joaquin Valley growers are experiencing high temperatures (103F+) as new crop round and Roma tomato production starts up

-

- Less overall acreage was planted due to water restrictions; however, supply should meet overall summer demand

- Large sizes are abundant

- Expect to see higher FOBs than normal later this season due to the reduction in acreage

- Mexico’s Baja Peninsula has steady of round, Roma, cherry, and grape tomato volume

- Overall sizing is skewed to the larger end of the spectrum

- Quality is excellent

- Fruit from Eastern Mexico (crossing in McAllen, Texas) is filling any order gaps

- Prices are expected to remain steady over the next two weeks

Please contact your Markon customer service representative for more information.

©2022 Markon Cooperative, Inc. All rights reserved.