California Strawberries

Supplies continue to tighten; markets are climbing. Expect stocks to continue to decline over the next two to three weeks as the Salinas/Watsonville season is past peak production.

Salinas/Watsonville

- Markon First Crop (MFC) Strawberries are available

- As the season moves past its peak, stocks continue to diminish

- Quality will improve as ideal growing temperatures are forecast this week

- Size currently ranges from small to medium (20-24 per one-pound clamshell)

- Expect markets to continue rising over the next 7 to 10 days

Santa Maria

- Stocks are declining as fields move past peak production for the spring crop and into the summer season over the next two weeks

- Quality will improve as ideal growing temperatures are forecast this week

- Expect markets to continue climbing over the next 7 to 10 days

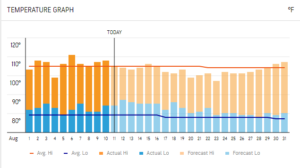

From The Fields: California Weather Update

Many California growing regions including the Salinas Valley, Santa Maria, and Oxnard continue to experience temperatures and humidity levels that are consistently above seasonal averages. Although coastal areas will remain in the 60s to mid-70s, the bulk of inland areas within these regions will see temperatures in the upper 70s to low 90s this week. The combination of high humidity and elevated temperatures has been wreaking havoc on commodity and value-added lettuce and tender leaf items in particular. The forecast calls for little or no relief throughout the month of August, which will prolong many of the quality and supply issues mentioned below.

Markon inspectors have been observing the following issues/concerns in lettuce items:

- Bolting/seeder

- Internal burn

- Insect pressure

- Sun scald/sun burn

- Mildew pressure

- Inconsistent growth/fluctuating density

- Shortened shelf-life

Tender leaf items are also susceptible to stress from heat and humidity, and have been exhibiting some of the following issues

- Bolting/seeder

- Decreased volume/yield

- Inconsistent growth

- Insect pressure

- Shortened shelf-life

- Supply shortages specific to cilantro)

Maintaining the cold chain throughout distribution is critical for maximizing quality and shelf-life. Markon inspectors will be monitoring quality and working with suppliers to select the best product available.

Green Leaf, Iceberg, and Romaine

Green leaf, iceberg, and romaine supplies have been impacted by disease pressure and high temperatures, particularly in south Salinas Valley. Although supplies will remain adequate through the month of August, many growers are seeing reduced yields that are causing markets to rise.

- MFC Premium Green Leaf is available

- Despite the warm weather, case weights are high with above-average quality

- Some lots are showing dense heads, fringe burn, and occasional weak tip but these issues are easily avoided by harvesting crews

- Markets are forecast to climb over the next 10-14 days, but no major gaps or shortages are predicted

- MFC Premium Iceberg and Romaine are available; a limited amount of Markon Best Available is being substituted due to low case weights and quality concerns

- Recent high heat and humidity are causing varying levels of internal burn, growth crack, seeder, salt and pepper, mildew, and thrip damage

- Iceberg prices will rise over the next 10-14 days; yields are falling due to heat, increased disease pressure, and strong demand

- Romaine markets are climbing due to reduced plantings as well as elevated pest and disease pressure in second plantings

Green Onions

The market is escalating. Persistently elevated temperatures are leading to low yields in the primary growing region of Mexicali, Mexico.

- Ready-Set-Serve Green Onions are available

- Elevated daytime temperatures experienced over the past month, combined with higher-than-average nighttime temperatures, have lowered yields and accelerated growth

- Hot weather without nighttime cooling relief has led to warmer-than-normal ground temperatures, increasing thrip/pest pressure

- Labor has been difficult to source, with harvesting made more complicated by the recent heat and reduced trucking capacity

- Logistically, there are delays in border crossing times due to increased inspections at the Southern U.S. border, further hampering inbound supplies

- Limited harvestable onions are the result of rapid growth combined with lower yields

- September temperatures are forecast to be closer to seasonal averages

- Expect elevated markets for the next four weeks at minimum

Labor Day Schedule 2022

Markon’s buying office will be closed for Labor Day (Monday, September 5); many processors will adjust loading and production schedules due to the holiday.

- Markon’s consolidation dock (Misionero, located in Salinas, California) will load as normal

- Taylor Farms’ loading docks will have regular loading hours

- The 4Earth consolidation dock will have regular loading hours on Labor Day (Monday, September 5)

o The Los Angeles Produce Market will be closed

o 4Earth will not be able to purchase off the market

- Northwest shippers’ sales offices and loading docks will load by appointment only on Saturday, September 3, but will be closed Sunday, September 4 and Labor Day (Monday, September 5)

Onions

The California and New Mexico summer seasons continue to wind down. Limited supplies of new crop onions are on the market in the Northwest.

New Mexico

- Size has begun to decline in remaining yellow onion supplies, with fewer colossals and super colossals available; onions pack-outs are heaviest to medium and jumbo sizes

- Red onion supplies are ample; prices continue to inch down

- White onion volume is low; expect markets to increase

- The New Mexico season will run through the end of next week, with limited availability the week of August 22

California

- Several growers have depleted supply; others will have onions through next week

- Stocks are currently sufficient to meet demand for the rest of the season

- Yellow onion pricing has eased, as demand has shifted to the Northwest

- Red onion demand is weak; markets continue to inch down

Northwest

- Washington stocks are on the market; size is small in early yields, favoring medium and jumbo onions

- In the Idaho/Oregon region, shipping began the week of August 8 with low volume

- Most suppliers will start the week of August 15

- Size will also be on the smaller end to start, with limited colossal and super colossals

- Colorado production is forecast to begin the week of August 22

- Washington onions will be hauled to Utah to kick that season off; Utah-grown onions will hit the market in early September

- Expect elevated prices through August

Potatoes- Storage supply nearly depleted, new crop relief still several weeks away

The few remaining sheds Burbank supplies will empty out their final storage facilities by early next week. The next few weeks will be the most challenging for ordering potatoes on record. Historic pricing levels will be met daily.

Remaining Storage Stocks

- Most Idaho suppliers are experiencing a supply gap between storage and new crop

- A limited number of order shipments will occur each day to retain as many stocks as possible

- Sheds with product need to slow production to stretch volume out over the next few weeks and avoid a supply gap

- Daily size substitutions will be required for best order fulfillment; expect requested ship dates to be adjusted for allocation

- 40- to 80-count stocks remain extremely limited; 90- to 120-count supplies continue to tighten

New Crop Potatoes

- New crop production is underway in Washington

- Volume is low

- Washington may supplement supply shortages in Idaho; however, due to small size and currently limited supply, this has not been a viable option yet

- A few Idaho suppliers in the central part of the state have begun to harvest in a very limited manner

- The bulk of Idaho production will begin the week of August 22

- Idaho and Washington growers anticipate early season yields to be dominated by 70- to 90-count potatoes

- Size profile is not expected to increase until September; there will be limited 40- to 60- count potatoes available

- U.S. No. 2 production will be low until potatoes are shipped out of storage, as supplies look their best straight out of the field

- Colorado and Wisconsin production will begin in September

- Limited quantities of Texas potatoes are forecast to ship the week of August 15

- Expect elevated markets and supply struggles to persist into September

Squash

East Coast supplies are tightening due to recent weather. Markets are up slightly.

- East Coast volume and yields (out of Michigan, Ohio, New Jersey, and New York) are limited this week due to past rain/hot weather

-

- Zucchini quality is good with some minor scuffing visible; yellow squash quality is average

- Rain and cooler temperatures this week will limit supply in the Great Lakes region

- North Carolina will start new fields at the end of August

- California has steady volume out of Santa Maria and will ramp up over the next week as they work new fields; quality is very good

- The Baja Peninsula has limited supply as some growers have finished until mid-September

- Expect markets to increase slightly over the next week

Please contact your Markon customer service representative for more information.

©2022 Markon Cooperative, Inc. All rights reserved.